Many federal student loan borrowers at risk of delinquency when forbearance ends, NY Fed warns

Federal student loan borrowers in the Direct Loan program may face difficulty when payments resume in May, according to a report from the New York Federal Reserve. (iStock)

Nearly 37 million Americans with federal Direct student loans will be expected to restart payments this May after more than two years of COVID-19 emergency forbearance. However, these borrowers may be at risk of delinquency when payments resume, according to a new report from the Federal Reserve Bank of New York.

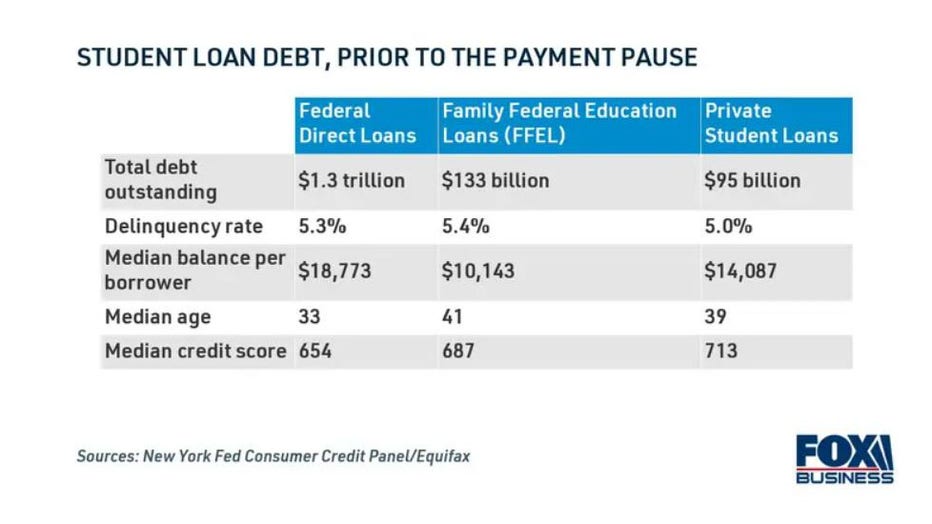

Using Equifax credit reporting data, New York Fed economists determined how pandemic forbearance impacted repayment progress and delinquency rates for consumers with different types of student loans. This includes the 10 million Americans who weren't eligible for the payment pause because they have private student loans or Federal Family Education Loan (FFEL) Program loans owned by commercial banks.

Although private student loan borrowers were able to accelerate repayment during the pandemic, economists found that borrowers with FFEL loans struggled to make payments. This could foreshadow "future repayment difficulties for Direct borrowers" — who tend to have lower credit scores and higher loan balances — they said, when the forbearance period ends in just over a month.

Keep reading to learn more about the New York Fed report, as well as how federal student loan borrowers can prepare for the end of forbearance through income-driven repayment, federal deferment or student loan refinancing. You can visit Credible to compare private student loan rates and determine if refinancing is the right strategy for you.

BIDEN ADMINISTRATION CONSIDERING ANOTHER STUDENT LOAN PAYMENT PAUSE EXTENSION

NY Fed predicts ‘meaningful rise’ in student loan delinquency after forbearance

Federal Direct loan borrowers tend to have higher debt balances and lower credit scores than borrowers with FFEL loans or private student loans, the report found. They were also making less progress on loan repayment before the pandemic began.

And although FFEL borrowers were more financially equipped with better credit scores and lower loan amounts, they still struggled to make payments during forbearance. As such, New York Fed researchers believe that "Direct borrowers are likely to experience a meaningful rise in delinquencies, both for student loans and for other debt, once forbearance ends."

PUBLIC SERVICE LOAN FORGIVENESS JUST GOT EASIER FOR 550,000 BORROWERS

Borrowers who are at risk of becoming delinquent after forbearance can consider enrolling in an income-driven repayment plan (IDR) or applying for additional federal student loan deferment. Another way to avoid delinquency is by refinancing to a private student loan at a lower interest rate. Student loan refinancing may help some borrowers reduce their monthly payments, making it easier to enter repayment.

It's important to note, though, that refinancing federal student debt into a private loan makes borrowers ineligible for certain protections like IDR plans and select student debt cancellation programs, including the Public Service Loan Forgiveness program (PSLF). You can learn more about student loan refinancing on Credible to determine if this option is right for your circumstances.

100,000 BORROWERS NOW QUALIFY FOR STUDENT LOAN DISCHARGE UNDER PSLF WAIVER

Policymakers urge action to help borrowers enter repayment

Student loan delinquency can leave a lasting negative mark on a borrower's credit report. Having bad credit can make it harder for consumers to lock in favorable borrowing terms on a number of financial products, from mortgages to auto loans.

Education Department officials have proposed that federal student loan servicers should temporarily suspend reporting delinquent borrowers to the credit bureaus when payments resume. But while this may "allow borrowers to better ease into repayment," it won't address the underlying issues, New York Fed researchers said.

If a borrower is delinquent for a prolonged period, they may default on their student loans — which comes with much more serious consequences. During default, the entire loan balance plus interest becomes immediately due through a process known as acceleration. Loan servicers may sue defaulted borrowers to recuperate the balance, which can result in wage garnishment and a suspension of federal benefit payments.

To address the long-term consequences of delinquency, some Democrats have urged federal student loan forgiveness. Although the Education Department has canceled about $16 billion worth of student debt since President Joe Biden took office, his administration has so far been unable to enact widespread forgiveness.

With the future of student debt cancellation unclear, borrowers may be looking for other ways to prepare for federal student loan repayment in May. Besides IDR plans and federal deferment programs, another option to consider is student loan refinancing. You can browse current student loan rates from private lenders in the table below, and use Credible's student loan calculator to estimate your new loan payments.

WHAT TO KNOW ABOUT THE TEACHER LOAN FORGIVENESS PROGRAM

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.