This is the state where student loan borrowers struggle the most to repay their debt: report

A new study compared the average student loan debt to median annual earnings for student loan borrowers two years after graduation. See what you can do if you want to avoid delinquency. (iStock)

Student loan payments can drain your wallet and throw your budget off balance. But for borrowers in some states, the burden of student loan debt weighs even more heavily, according to a new report.

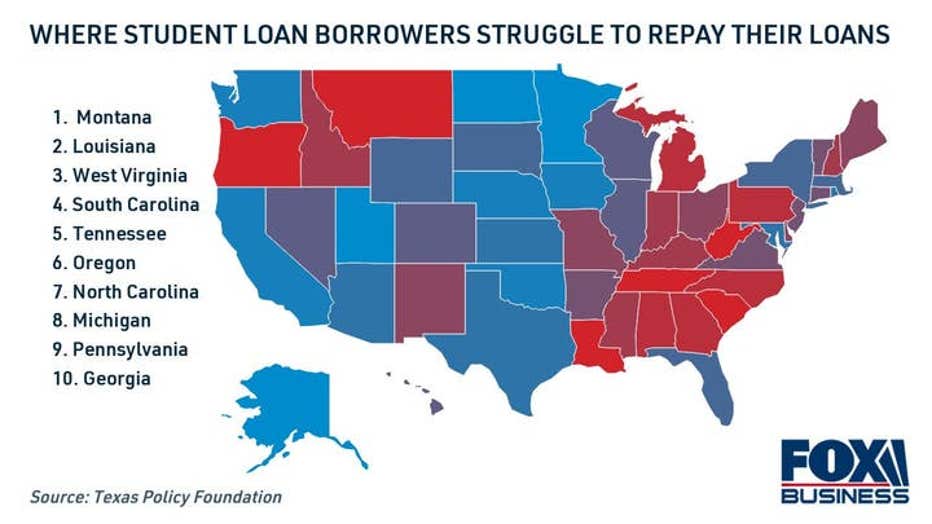

Dr. Andrew Gillen of the Texas Public Policy Foundation analyzed Education Department data to determine where borrowers had the highest percentage of student loan debt to annual earnings two years after graduation. He found that student loan borrowers in Montana struggle the most to repay their debts.

Aside from Montana, most of the other states where borrowers have poor debt-to-earnings outcomes are in the South. Student loan borrowers in Louisiana, West Virginia, the Carolinas, Tennessee and Georgia are among the most impacted by unmanageable student loans.

WHITE HOUSE RECONSIDERING STANCE ON FEDERAL STUDENT LOANS IN BANKRUPTCY

Generally, borrowers struggle the least to repay their student loans in the West and parts of the Midwest. North Dakota residents have an excellent percentage of debt to earnings after graduation, the report found. Other states where borrowers have a better debt-to-earnings ratio include Minnesota, Utah, Alaska and California.

Keep reading to learn more about what you can do if you're struggling to repay your student loan debt, such as refinancing. Visit Credible to compare student loan refinance rates for free without impacting your credit score.

AOC TELLS DEMOCRATS IT’S TIME ‘TO BRING THE HEAT ON BIDEN TO CANCEL’ STUDENT LOANS

What to do if you're struggling to repay your student loans

Federal student loan payments are paused until February 2022, but that's just a few months away. If you're not ready for the forbearance period to end — or if you're struggling to repay private student loan debt — consider your options below:

- Enroll in an income-driven repayment plan (IDR). Federal student loan borrowers can enroll in an IDR plan to limit their monthly payments to 10-20% of their discretionary income on the Federal Student Aid (FSA) website.

- Apply for additional federal forbearance. COVID-19 administrative forbearance expires in January 2022. If you won't be ready to resume payments, apply for up to 36 months of additional forbearance through economic hardship or unemployment deferment.

- Lower your monthly payments by refinancing. By locking in a lower student loan rate, you may be able to reduce your monthly payments and save money on interest over time. Well-qualified Credible borrowers were able to save more than $250 per month by refinancing.

BIDEN ADMINISTRATION BEGINS NOTIFYING BORROWERS OF STUDENT LOAN SERVICER CHANGES

It's important to know that refinancing your federal student loan debt into a private loan would make you ineligible for certain government protections like IDR plans, zero-interest forbearance and student loan forgiveness programs.

Get in touch with a knowledgeable loan officer at Credible who can help you determine if student loan refinancing is right for you.

MILLENNIAL, GEN Z STUDENT LOAN BORROWERS PLAN TO LOWER PAYMENTS WITH REFINANCING, SURVEY FINDS

How to decide if you should refinance your student loans

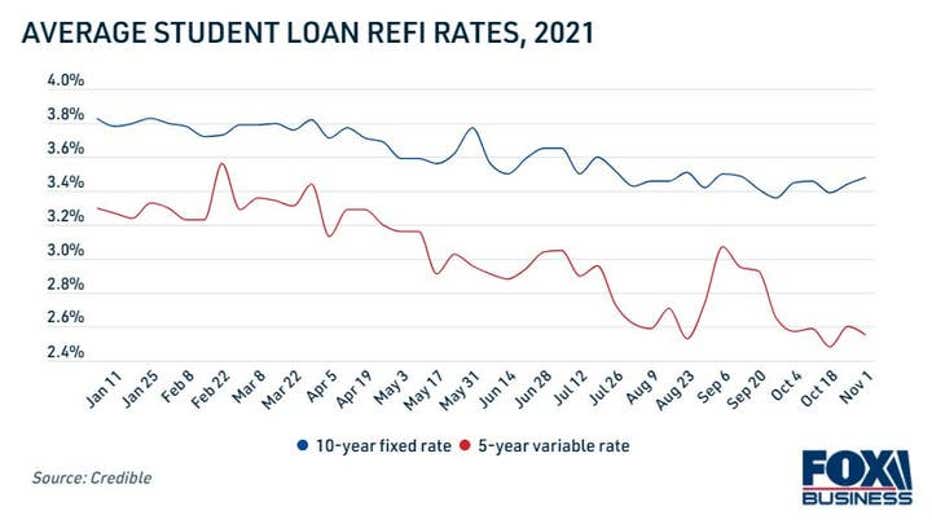

Student loan refinancing can help you pay off your loans faster or save money on your monthly payments. Plus, now is a good time to lock in a private student loan rate while interest rates are historically low, according to data from Credible.

PUBLIC SERVICE LOAN FORGIVENESS PROGRAM CALLED ‘BROKEN’ & ‘CONFUSING’ BY BORROWERS

Whereas federal student loan rates are dependent on the year that you borrowed them, private student loan rates vary from lender to lender based on the borrower's creditworthiness. Borrowers with good credit will be eligible for lower interest rates and the best loan repayment terms. Bad credit borrowers, on the other hand, should consider enlisting the help of a creditworthy cosigner to lock in a better rate.

Browse student loan rates from real private lenders in the table below, and use a student loan refinance calculator to see if this option is worthwhile.

WARREN SAYS PRESIDENT BIDEN 'HAS THE POWER TO CANCEL STUDENT LOAN DEBT'

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.