What is a home equity line of credit and how does it work?

Our goal here at Credible Operations, Inc., NMLS Number 1681276, referred to as "Credible" below, is to give you the tools and confidence you need to improve your finances. Although we do promote products from our partner lenders, all opinions are our own.

A home equity line of credit (HELOC) can allow you to tap into your home equity to cover just about any expense. (iStock)

Home equity is defined as the gap between what your house is worth and what you owe on your mortgage. Put simply, it’s the amount of your home that you actually own.

If you have home equity, you may want to tap into it to add value to your home, pay off debt or meet other goals. One way to do so is through a home equity line of credit, or HELOC.

A cash-out refinance is another way to tap your home’s equity. Credible makes it easy to compare mortgage refinance rates from multiple lenders.

- What is a home equity line of credit and how does it work?

- How to qualify for a HELOC

- When a HELOC makes sense

- HELOC vs. home equity loan or cash-out refinance

- Pros and cons of a home equity line of credit

- Where to get a home equity product

What is a home equity line of credit and how does it work?

A HELOC is a revolving line of credit that allows you to borrow money against a portion of the equity in your home, usually up to 85%. It works much like a credit card — you’ll be able to withdraw as much or as little as you’d like up to a set credit limit. Eventually, you’ll repay the amount you borrowed plus interest. Note that HELOCs come with variable interest rates, which typically move with the prime rate and can fluctuate over time.

A HELOC has two important phases: the draw period and repayment period. During the draw period, which may last five to 10 years, you’ll use special checks or a credit card to borrow money when you want to and only make minimum payments.

Once the draw period comes to an end, you won’t be able to borrow against your credit limit anymore. And you’ll have to repay the principal you borrowed plus interest. Depending on your agreement with the lender, you may have to repay the balance immediately, or you may have a period of time — typically 10 to 20 years.

It’s important to note that some HELOCs have balloon payments — larger, lump-sum payments due at the end of the repayment term to cover any remaining balance. If your HELOC agreement includes a balloon payment, you may have to come up with thousands (or even tens of thousands) of dollars at once.

Fortunately, you have some ways to get out of a HELOC balloon payment. If you have enough cash on hand, you can pay off your HELOC in cash before the balloon payment is due. You may also refinance your HELOC or use a balance transfer credit card with a 0% intro annual percentage rate, or APR.

Common uses of a HELOC

One of the benefits of a HELOC is its versatility. You can use it to cover just about any type of expense. Some of the most common uses for HELOCs include:

- Home improvement projects — If you’d like to update your home, a HELOC is a great option. You can withdraw funds to remodel your kitchen, add an office, finish your basement or anything else. It’s a good idea to choose home improvement projects that increase your home’s value.

- Debt consolidation — Consolidating your debt with a HELOC may make sense if you’re overwhelmed with high-interest credit card debt. With a HELOC, you can save hundreds or even thousands of dollars in interest. But keep in mind that a HELOC could put your home at risk if you’re unable to repay the credit as agreed. Credit card debt is not secured by your home.

- Medical expenses — Unfortunately, insurance doesn’t always cover all your medical expenses. If you’re facing out-of-pocket healthcare costs and don’t have the cash to cover them, a HELOC may be an option.

How to qualify for a HELOC

If you’d like to take out a HELOC, you’ll need to meet certain qualification requirements. While every lender has its own unique criteria, most want to see a credit score of at least 680.

Lenders will also look at your pay stubs and account statements so they can understand your employment situation and debt-to-income ratio, or DTI, which compares the amount of your total income that goes toward debt. The lower your DTI, the better. Lenders usually prefer a DTI of 43% or lower.

In addition, lenders will look at your loan-to-value ratio, or LTV, to determine how much money you can borrow. Your LTV is your current mortgage balance divided by the current appraised value of your home. Most lenders require that your LTV ratio is no more than 85%.

Let’s say your house is worth $300,000 and you owe $210,000 on your mortgage. In this situation, your loan-to-value ratio is 70%. If your lender offers HELOCs with a maximum LTV ratio of 85%, you’re in good shape.

Keep in mind that some HELOC lenders may have more lenient requirements. If you come across a lender that accepts borrowers with lower credit scores, for example, take a close look at its rates and fees as they may be high.

When a HELOC makes sense

A HELOC may be a good option if you want to fund a home improvement project that will improve your home’s value. In this situation, you might be able to claim the mortgage interest deduction on your federal tax returns, provided you meet all the requirements for taking the deduction. It’s a good idea to consult a tax adviser if this is your goal.

You might also want to consider a HELOC if you plan to purchase a vacation home or another real estate property. It can help you cover the costs of the down payment and closing costs.

Of course, HELOCs come with a price, so be sure you can afford the various closing costs before you open one. These costs will depend on the lender but may include application fees, appraisal fees and recording fees.

When to think twice before getting a HELOC

While a HELOC is a good choice for some people, it’s not right for everyone. If you only need a small amount of cash, a HELOC isn’t worthwhile. Since the fees may exceed the amount you wish to borrow, you might be better off with a 0% intro APR credit card, if you’re able to qualify for one.

Also, if you’re worried that you could spend more money than you actually need to, a HELOC can steer you into a cycle of debt. You should also avoid this financing product if you’re unsure of your future earnings and don’t feel confident that you’ll pay off what you borrow.

In addition, don’t use a HELOC — or any other form of credit, for that matter — to meet basic expenses like food and utilities. Instead, focus on how to increase your income and pay down your debt so you can improve your financial situation.

HELOC vs. home equity loan or cash-out refinance

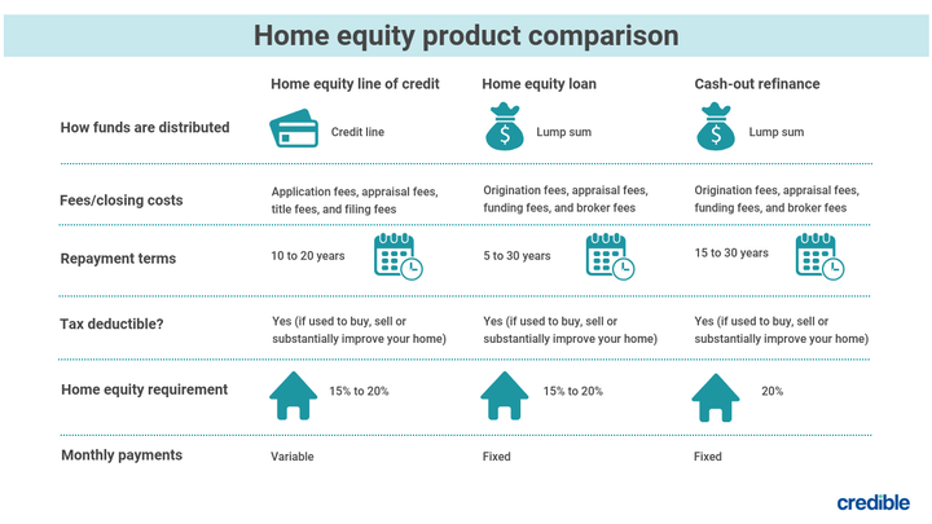

Home equity credit lines aren’t the only way to tap the equity in your home. You may also take out a home equity loan or cash-out refinance.

With a home equity loan, the lender disburses a lump-sum payment, which you’ll repay in monthly installments. A cash-out refinance replaces your original mortgage with a new loan for more than you owe on your house. You receive the difference in cash, which you can use for virtually any expense.

Here’s a comparison of three ways to tap your home’s equity:

Pros and cons of a home equity line of credit

Every financial product has noteworthy advantages and disadvantages. A HELOC is no exception. By comparing the benefits and drawbacks of this option, you can make an informed decision for your unique situation.

Pros

- Withdraw money when you need to — HELOCs give you the flexibility to borrow at any time during the draw period. This is great news if you’re unsure exactly how much money a home improvement project or other expense will cost you.

- Only pay for what you borrow — With a HELOC, you’ll be able to borrow as much as you want up to a set credit limit. But you’ll only pay interest on what you actually use, not the total amount available to you.

- May be tax deductible — If you put your HELOC funds toward a home improvement project to repair or substantially improve your home, you might be able to take the mortgage interest tax deduction if you meet all requirements for it.

- Affordable interest rates — Compared to some credit cards and personal loans, HELOCs come with lower interest rates. This means you may be able to save hundreds or even thousands of dollars if you go this route.

- Can use funds for any purpose — Whether you’d like to pay for major purchases like furniture or home repairs or simply want to go on vacation, a HELOC can help. There are no restrictions on how you can use the money you withdraw. That said, think twice before putting your home at risk to fund something that’s a want, rather than a need.

Cons

- Must have good credit — In general, you need a high credit score to get approved for a HELOC. If you don’t have the best credit, it may not be an immediate option for you.

- Closing costs — HELOCs aren’t free. You’ll have to pay closing costs that are similar to those of a first mortgage.

- Ongoing fees — In addition to closing costs, some lenders charge yearly fees to keep your HELOC open, often called annual fees or membership fees. You may also have to pay fees if you don’t use your HELOC or terminate it early.

- Unpredictable interest rates — Since most HELOCs have variable interest rates, your monthly payments may go up or down when it’s time to repay your loan. Fluctuating payments can be stressful, especially if you’re on a tight budget.

- Potential of foreclosure — A HELOC uses your home as collateral. If you default on it, the lender may foreclose on your home.

Where to get a home equity product

You may find HELOCs, home equity loans and cash-out refinances at banks, credit unions and online lenders. While some lenders offer all three home equity products to borrowers, others only focus on one or two.

To find the ideal option for your situation, it’s important to do your research, shop around and compare the products available to you. Explore the requirements, rates, terms and fees of each choice so you can make the very best decision.

If you decide a cash-out refinance is a better fit for your financial goals, you can compare mortgage refinance rates from multiple lenders in minutes using Credible.