Fed keeps interest rates at 0% - how your loans are affected

The Federal Reserve kept interest rates steady at its latest meeting, but they could be going up soon. Here's what will happen then, and what you should do with your finances to prepare. (iStock)

The Federal Reserve held its Federal Open Market Committee (FOMC) meeting on June 15-16, holding interest rates steady near zero for the time being. However, the Fed raised its forecast for inflation, suggesting that interest rates may rise sooner than expected — and that we may see two rate hikes in 2023.

The Fed rate has an effect on virtually every financial product that comes with an interest rate, including mortgages, student loans, personal loans and credit cards. When the Federal Reserve increases the benchmark rate, banks and lenders must also increase rates in order to make a profit.

FEDERAL RESERVE ELECTS TO HOLD INTEREST RATES AT 0%

Since interest rates are still low and will remain at 0% for now, it's a good time to secure a low interest rate on these types of products. If you were thinking of taking out a loan or refinancing an existing loan, it's smart to do it sooner rather than later since rates are expected to rise soon.

See how potential rate hikes will affect your existing loans and any future financial products in the breakdown below. To take advantage of interest rates while they're low, shop around for a variety of financial products on Credible's online marketplace.

Mortgage and mortgage refinancing

Fixed-rate mortgages tend to rise and fall with the 10-year Treasury rate set by the Fed. When the Fed rates rise, so do rates for popular 30-year fixed-rate mortgages. Mortgage rates are also affected by demand and inflation, as well as investor activity.

With the Fed rates near zero, mortgage rates have remained steadily low. Mortgage interest rates hit historic lows this year, dipping as low as 2.65% for a 30-year fixed-rate mortgage in January 2021 and 2.24% for a 15-year fixed-rate mortgage in June 2021, according to Freddie Mac.

Mortgage rates are expected to rise when the Federal Reserve issues its next rate hike, which is forecasted to happen in 2023. If you haven't already refinanced your mortgage, it's advisable to do so as soon as possible while rates are low. You can compare mortgage refinancing and mortgage purchase rates on Credible's online marketplace to make sure you're getting the lowest rate possible for your situation. Doing so will not affect your credit.

WHY YOU SHOULD REFINANCE YOUR MORTGAGE INSTEAD OF WAITING FOR FORBEARANCE AND FORECLOSURE EXTENSIONS

Student loans and student loan refinancing

Congress sets federal loan interest rates, so they're not directly affected by the Fed rate in the same way that other loans are. It's not recommended to refinance your federal student loans anyway, since doing so means you'll lose federal protections like forbearance and income-based repayment.

But if you're considering refinancing your student loans, the Fed rate may affect these interest rates. Private student loan refinancing rates are at historic lows, so there's never been a better time to refinance your student loans.

Borrowers who refinanced their student loans to a shorter term using Credible saved $17,344 on average. See how much you could save on your loans by using a student loan refinancing calculator.

STUDENT LOAN REFINANCING RATES DROP AGAIN TO RECORD LOW: HOW TO FIND YOUR RATE

Personal loans

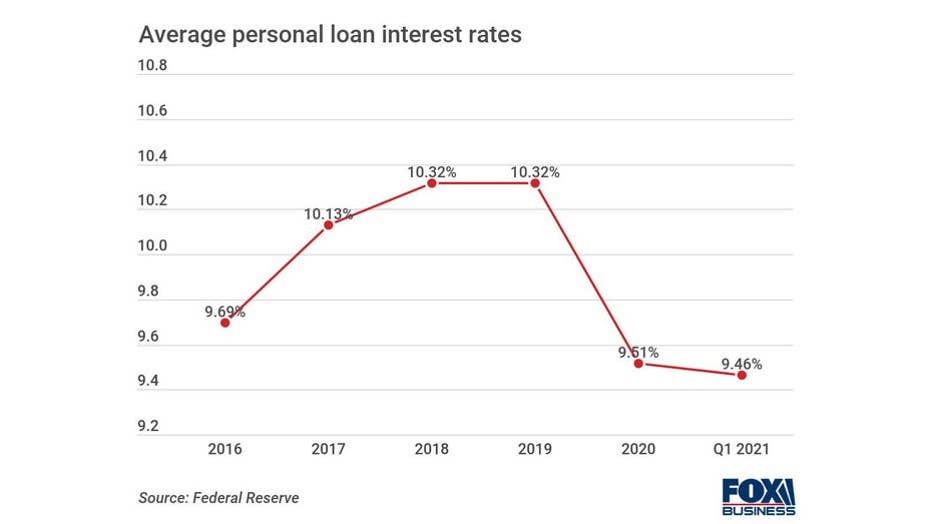

Much like other financial products, rates for personal loans are affected by the Fed rate. The average interest rate on a two-year personal loan fell drastically from 2019 to 2020, when the Federal Reserve first slashed rates. Personal loan interest rates have remained low since then, and they're holding steady at 9.46%.

While personal loan interest rates are low, it's a good time to use one to consolidate higher-interest debts, like credit cards and payday loans, for instance. Doing so can save you money on interest in the long run and even help you pay off debt faster, as long as you can secure a lower interest rate than what you're paying on your current debts.

Keep in mind that since they are unsecured and do not require collateral, personal loans tend to have carry a wide range of interest rates – from about 4% to 36%. Personal loan rates are also heavily impacted by the borrower's credit score and debt-to-income ratio, so it's important to work on improving your credit and increasing your income before you apply.

The most effective way to get a good rate on a personal loan is to shop around through multiple lenders. You can compare personal loan rates without affecting your credit score on Credible.

PERSONAL LOAN VS. CREDIT CARD — WHEN TO USE EACH ONE

Credit cards

Credit cards come with variable interest rates, so new and existing credit card interest rates can fluctuate with the Fed rate. Much like personal loans, credit cards are typically unsecured, which means that interest rates are impacted by a borrower's credit history, as well.

It's best to pay off your credit cards every month to avoid paying interest altogether, but that's not always possible. Since rates are low, it may be smart to take out a balance transfer credit card so you can pay off your credit card debt at a lower interest rate than you're currently paying.

Shop around for credit cards, including balance transfer credit cards, on Credible.

JANET YELLEN: INTEREST RATES MAY NEED TO RISE TO ENSURE ‘ECONOMY DOESN'T OVERHEAT’

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.